MASFIN: A Multi-Agent System for Financial Forecasting

Note: This research was conducted in Summer 2025 with Muhlenberg undergraduate student researcher, Sebastian Montalvo.

1. Introduction

Financial forecasting represents one of the most complex challenges in data-driven decision making due to market volatility, non-stationarity, and the integration of quantitative and qualitative signals. Recent advances in large language models (LLMs) have renewed interest in this space, particularly through multi-agent frameworks that allow modular reasoning, interpretability, and reproducibility.

In this project, we introduce MASFIN (Multi-Agent System for Decomposed Financial Reasoning and Forecasting) — a generative, bias-aware framework designed to integrate structured financial data with unstructured news while embedding safeguards against survivorship, hindsight, and overfitting biases.

2. Methods and Approach

MASFIN was implemented using CrewAI, organizing agents into five sequential “crews”:

- Postmortem Crew – Analyzes delisted or failed firms to counter survivorship bias.

- Screening Crew – Filters candidate equities using sentiment and real-time data.

- Analysis Crew – Evaluates financial ratios and technical indicators across tickers.

- Timing Crew – Determines appropriate entry points using historical-only signals.

- Portfolio Crew – Constructs a 15–30 stock portfolio with risk-adjusted allocations.

Each stage incorporates human-in-the-loop validation to ensure transparency and reduce hallucinations. Data were collected from Finnhub and Yahoo Finance, combining quantitative metrics with qualitative sentiment analysis.

3. Results

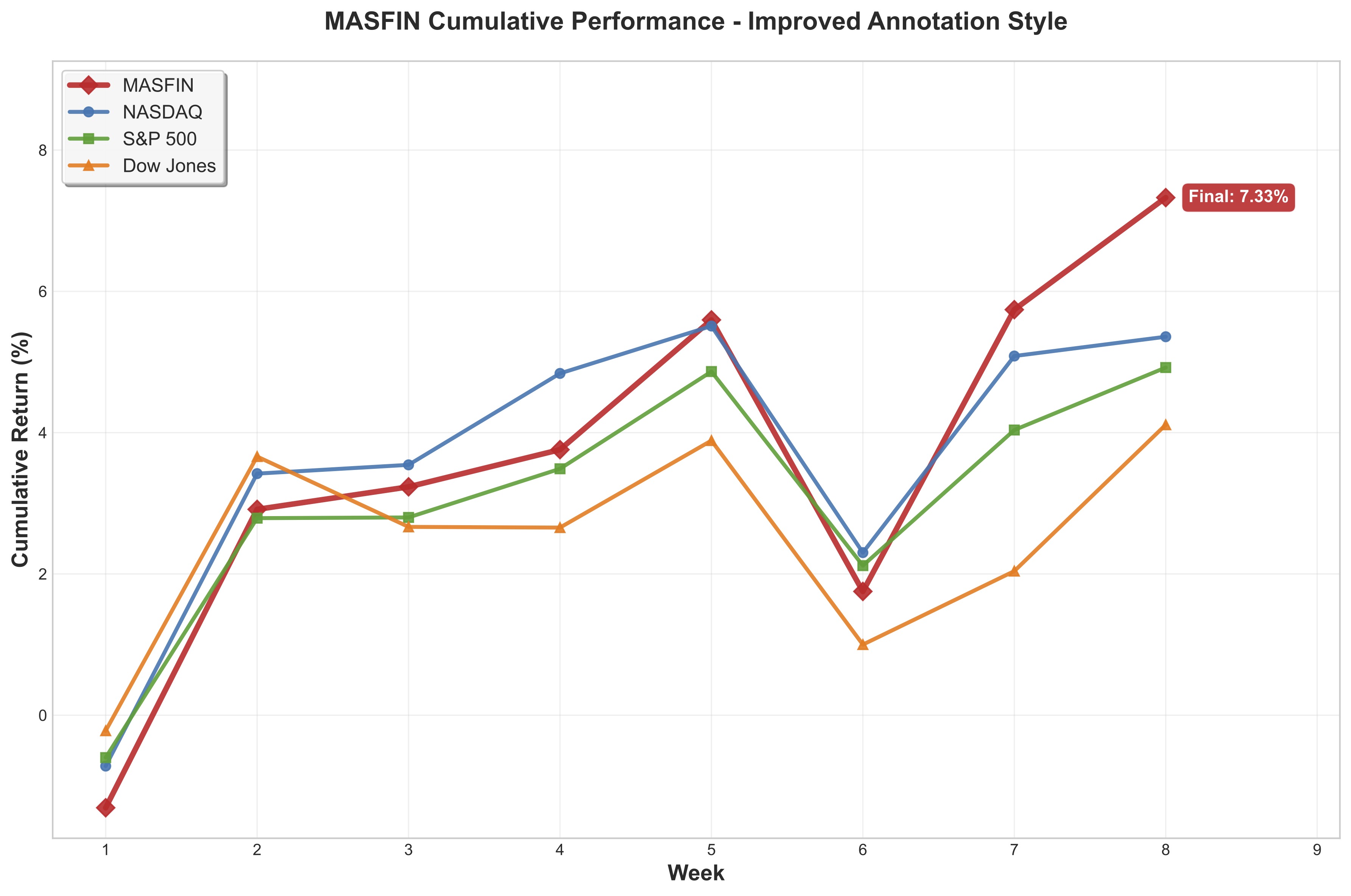

Over an eight-week live evaluation, MASFIN achieved a 7.33% cumulative return, outperforming the S&P 500 (4.92%), NASDAQ-100 (5.36%), and Dow Jones (4.11%) in six of eight weeks. The system exhibited higher volatility (2.61% weekly) but demonstrated a strong correlation with benchmark indices, suggesting enhanced performance within existing market trends.

These findings highlight the potential of modular, bias-mitigated generative systems for financial reasoning—offering improved reproducibility and interpretability compared to monolithic AI approaches.

4. Conclusion

MASFIN demonstrates how generative AI can be harnessed for transparent and reproducible financial analysis. By integrating bias-aware design and modular agent collaboration, this framework provides a foundation for future research in high-stakes, data-intensive domains.

Full paper and code are available at: github.com/mmontalvo9/MASFIN